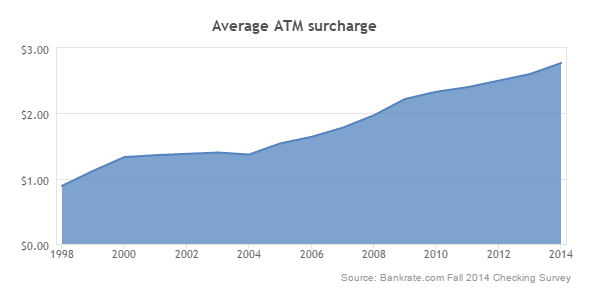

It’s not really news that ATM fees continue to increase year after year…but it is this year. Bankrate.com’s 17th Annual Checking Survey (2014) found that ATM fees jumped more than five percent over last year, reaching an all new high of $4.35 on average each time a cardholder uses an out-of-network ATM. Breaking it down, non-customers using another institution’s ATM bear the brunt of the fees, with the average surcharge that banks charge non-customers using their ATMs climbing 6.5 percent to $2.77 (making for the 10th consecutive year this fee has increased). The average fee assessed by one’s own financial institution for going outside the ATM network increased three percent to $1.58, also a new high.

As fees creep toward $5.00, there is no doubt cardholder behavior may be impacted. Bankrate.com notes that taking such a hit each time they visit a foreign ATM could persuade some cardholders to consider changing financial institutions—to the one with the most convenient ATMs. As a participant in Alliance One, your financial institution is providing an increasingly valuable benefit to your cardholders—one that notably reduces the burden of rising ATM fees by offering an expanded ATM footprint. And, one that helps them keep using your card.

Get the word out about Alliance One easily with an Alliance One App Promo kit. Newly added holiday/winter and New Year themes now available.